Moving Expenses Tax Deductible in Calgary: What You Can Claim, How It Works, and Local Expert Tips

Yes—moving expenses tax deductible rules in Canada can help you lower your tax bill if you moved for work, school, or business and meet CRA conditions. If you live in Calgary or nearby areas, this matters more than you think due to long commutes, job relocations, and Alberta’s fast-moving housing market.

At Calgary Movers, we help local families and professionals move smarter—and we regularly guide customers on moving expenses tax deductible basics so you can plan with confidence and keep more money in your pocket.

What Is Moving Expenses Tax Deductible & Why It Matters in Calgary?

Moving expenses tax deductible means you may be able to deduct eligible relocation costs from your taxable income when you move at least 40 km closer to a new job, business, or post-secondary school. In Calgary, this comes up often because people relocate between neighbourhoods, nearby towns, or even provinces for work in energy, tech, construction, and healthcare.

Here’s why it matters locally:

- Calgary covers a large geographic area, so qualifying distance thresholds are common

- Moves to or from Chestermere, Airdrie, Okotoks, Cochrane, or Strathmore often exceed 40 km

- Alberta’s job market frequently requires relocation for better opportunities

- Winter conditions increase professional moving costs, which strengthens the value of a moving expenses tax deduction

If you’ve been asking are moving expenses tax deductible in Canada, the short answer is yes—when CRA rules are met and expenses are properly documented.

What Moving Expenses Are Tax Deductible in Calgary?

Understanding moving expenses that are tax deductible helps you avoid missed deductions or CRA issues later. Based on our experience helping Calgary residents move every year, here’s what usually qualifies.

Eligible Moving Expenses Tax Deductible Costs

You may be able to deduct moving expenses from taxes such as:

- Transportation and storage of household goods

- Professional mover fees (local or long-distance)

- Packing and unpacking services

- Temporary storage costs

- Travel expenses (fuel, meals, accommodation)

- Lease cancellation penalties

- Utility disconnection and reconnection fees

- Temporary living costs (up to 15 days)

These costs fall under the moving expense tax deduction rules defined by the CRA.

👉 If you used professional services like our local moving services in Calgary or long-distance movers in Calgary, those invoices often qualify.

What Is Not Covered?

To be clear, moving expenses are tax deductible only for specific costs. You cannot claim:

- Real estate commissions

- Mortgage penalties

- Home renovations

- New furniture or appliances

- Loss on selling your home

Knowing the difference keeps your moving expenses tax deductions clean and audit-safe.

Why Choose Calgary Movers for Tax-Smart Moving in Calgary?

At Calgary Movers, we don’t just move boxes—we help you move strategically.

Why locals trust us:

- 10+ years of Calgary-specific moving experience

- Deep knowledge of CRA-compliant invoicing

- Transparent pricing with detailed receipts

- Trained crews for winter and long-distance moves

- Packing specialists and insured transport

- Consistently positive local reviews

Many clients tell us they chose us after learning their professional move could support a tax deduction on moving expenses. Our itemized invoices make claiming your moving expenses tax deductible costs much easier.

Learn more about our team on our About Us page.

Service Areas We Cover Around Calgary

We proudly support moves across Calgary and surrounding communities. These relocations often qualify for moving expenses tax deductible claims due to distance.

We serve:

Whether you’re moving within the city or relocating to another province, our first-rate movers in Calgary help you move efficiently and compliantly.

Local Case Study: Calgary to Airdrie Move

Last winter, we helped a client relocate from NW Calgary to Airdrie for a new engineering role. The move exceeded 40 km closer to work. We provided packing, transport, and short-term storage.

Result: The client successfully claimed over $4,000 in moving expenses tax deductible costs and reduced their taxable income significantly.

That’s real-world value—not theory.

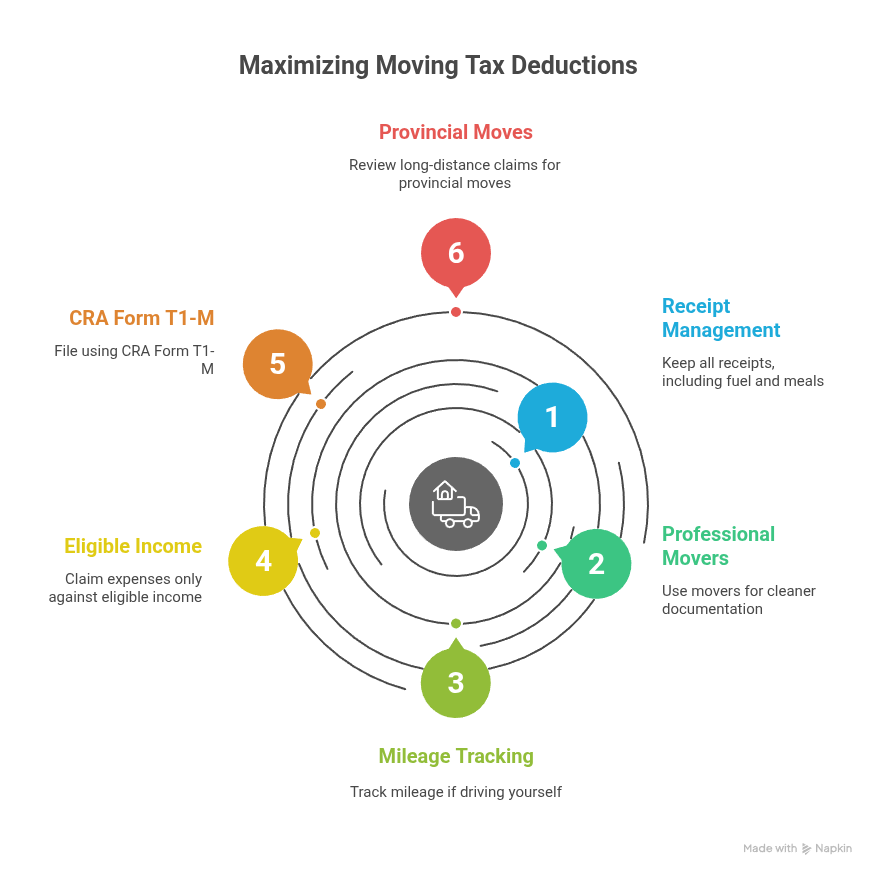

Expert Tips to Maximize Your Moving Expenses Tax Deduction

Here’s what we recommend as Calgary moving professionals:

- Keep every receipt, even fuel and meals

- Use professional movers for cleaner documentation

- Track mileage if you drive yourself

- Claim expenses only against eligible income

- File using CRA Form T1-M

If you’re planning a provincial move, you can also review how long-distance claims work by checking this external resource on long-distance movers in Toronto.

FAQs About Moving Expenses Tax Deductible

Are moving expenses tax in Canada?

Yes. Are moving expenses tax deductible in Canada depends on distance and purpose. You must move at least 40 km closer to a new job, business, or school and have eligible expenses with receipts.

Are moving expenses deductible on taxes for Calgary residents?

Yes. Are moving expenses deductible on taxes applies equally in Alberta. Calgary residents follow federal CRA rules, not provincial ones.

Which moving expenses are tax deductible most often?

The most common moving expenses that are tax deductible include mover fees, packing services, transportation, storage, and temporary accommodation.

Can I deduct moving expenses from taxes if I moved within Alberta?

Yes, if the distance rule is met. Many Calgary-to-Airdrie or Calgary-to-Cochrane moves qualify for moving expenses tax deductions.

Do I need professional movers for a moving expense tax deduction?

No, but professional movers make documentation easier. CRA accepts both self-moves and professional invoices, as long as costs are reasonable and documented.

Can students claim moving expenses tax costs?

Yes. If you moved for post-secondary education and met the 40 km rule, moving expenses tax claims may apply against scholarship or taxable income.

Is packing included in moving expenses tax claims?

Yes. Packing and unpacking services are commonly accepted moving expenses tax deductions when provided by a professional mover.

How long should I keep receipts?

Keep all records for at least six years. CRA may request proof for tax deduction on moving expenses claims.

Book Tax-Smart Moving Services in Calgary Today

If you’re planning a move and want to take advantage of moving expenses tax opportunities, work with professionals who understand both logistics and compliance.

👉 Book trusted movers today through our contact page or explore our packing and unpacking services in Calgary.

Get In Touch

Calgary Movers

📧 calgarymovingcompanyca@gmail.com

📞 (587) 605-5024

📍 1120 Centre St NW, Calgary, AB T2E 7K6, Canada